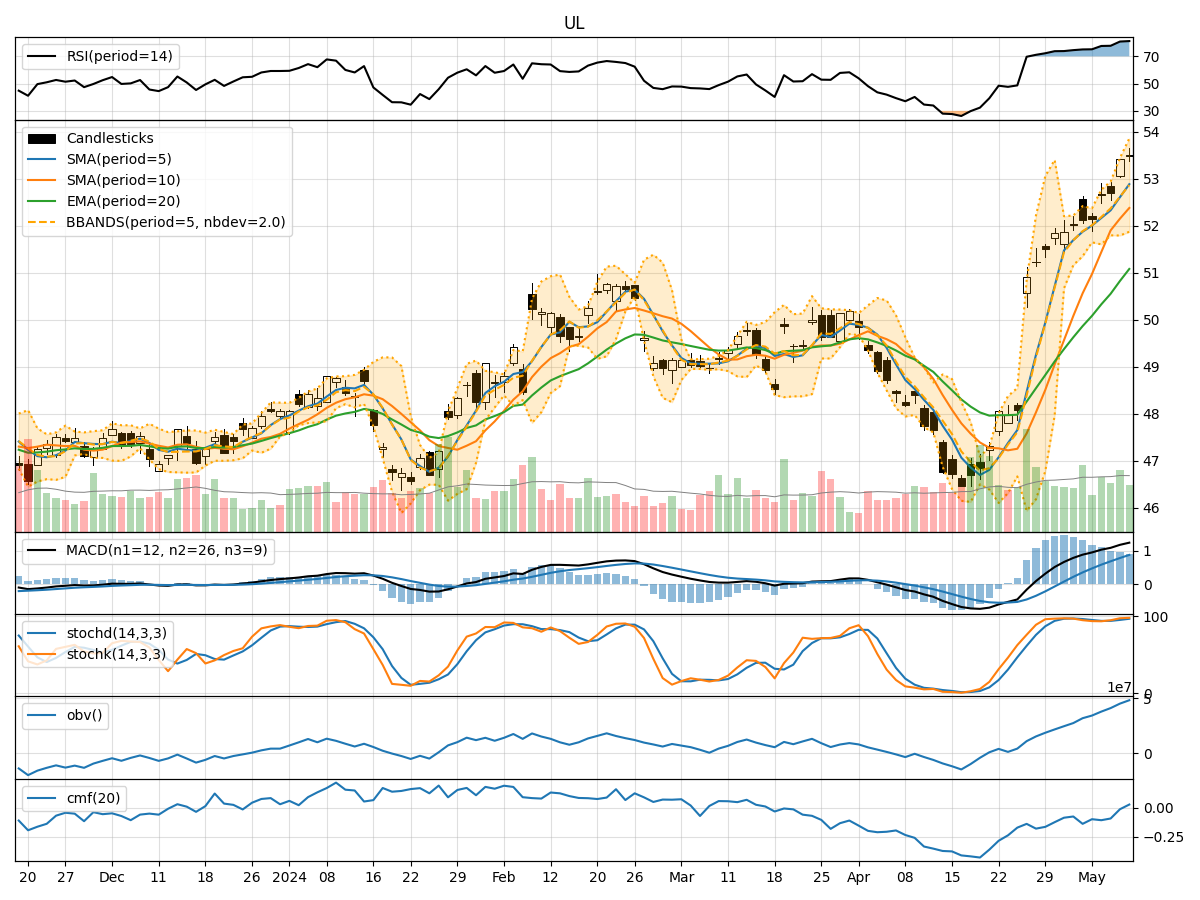

Technical Analysis of UL 2024-05-10

Overview:

In the last 5 trading days, UL stock has shown a consistent uptrend in both price and volume. The trend indicators such as Moving Averages (MA), MACD, and RSI all suggest a bullish sentiment. Momentum indicators like Stochastic Oscillator and Williams %R also indicate strong buying momentum. Volatility indicators show expanding Bollinger Bands, indicating increased price volatility. Volume indicators like On-Balance Volume (OBV) and Chaikin Money Flow (CMF) suggest accumulation of the stock.

Trend Analysis:

- Moving Averages (MA): The 5-day MA has been consistently above the 10-day SMA, indicating a short-term bullish trend.

- MACD: The MACD line has been above the signal line, showing a bullish trend.

- RSI: The RSI has been consistently above 70, indicating an overbought condition but also strong bullish momentum.

Momentum Analysis:

- Stochastic Oscillator: Both %K and %D lines are in the overbought zone, suggesting a strong buying momentum.

- Williams %R: The indicator is in the oversold territory, indicating a potential reversal to the upside.

Volatility Analysis:

- Bollinger Bands: The widening of the Bollinger Bands suggests increasing volatility in the stock price.

- Bollinger %B: The %B indicator is below 1, indicating that the stock price is trading below the upper Bollinger Band.

Volume Analysis:

- On-Balance Volume (OBV): The OBV has been steadily increasing, indicating strong buying pressure.

- Chaikin Money Flow (CMF): The CMF is negative but trending upwards, suggesting accumulation.

Key Observations:

- The stock is in a strong uptrend based on trend and momentum indicators.

- Volatility is increasing, which could lead to larger price swings.

- Volume indicators show accumulation, supporting the bullish bias.

Conclusion:

Based on the technical analysis of UL stock: - Overall View: The stock is bullish in the short term. - Price Movement: The next few days are likely to see upward movement in the stock price. - Recommendation: Consider buying or holding positions in UL stock for potential gains. - Risk Management: Keep an eye on overbought conditions and increasing volatility for proper risk management.

In conclusion, the technical indicators suggest a continuation of the bullish trend in UL stock. Traders and investors should monitor key levels and indicators for potential entry or exit points.