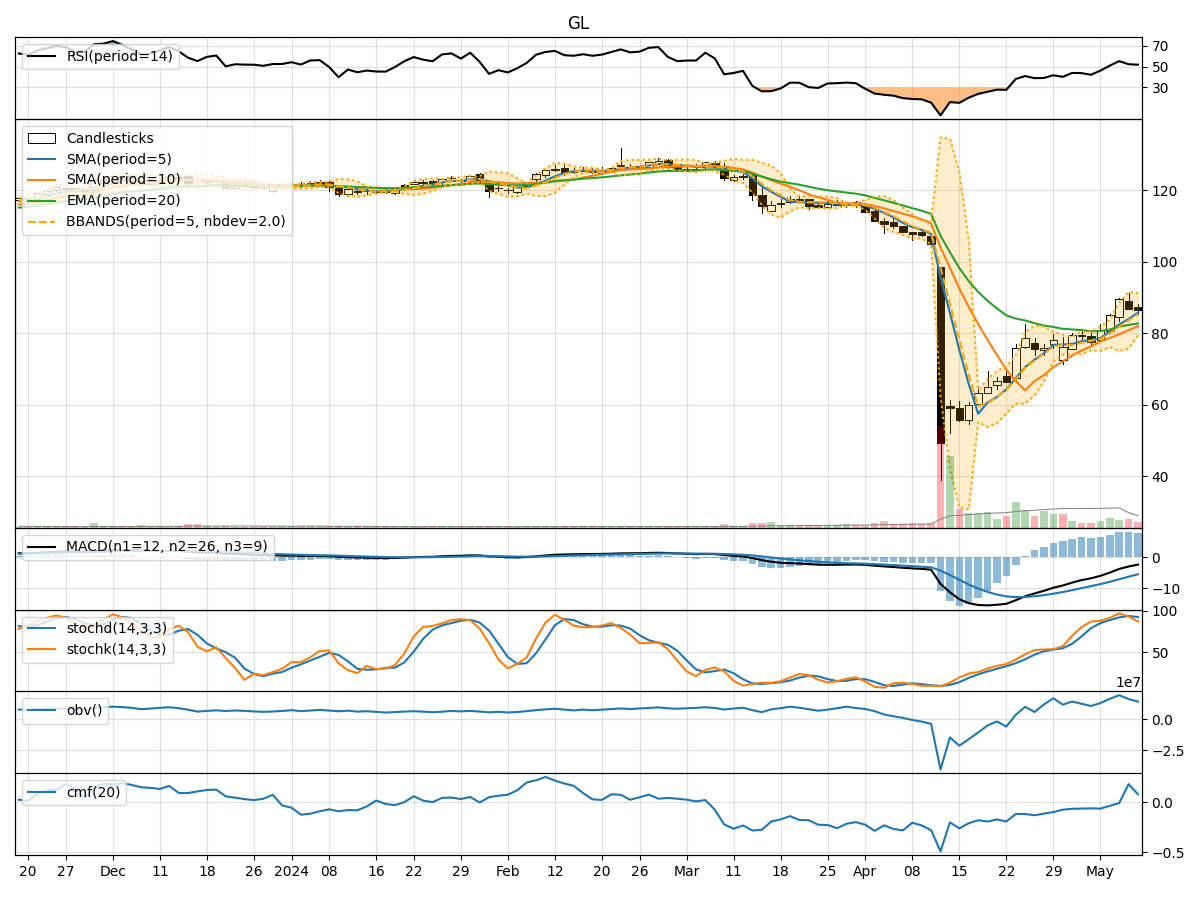

Technical Analysis of GL 2024-05-10

Overview:

In analyzing the technical indicators for GL stock over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible stock price movement in the coming days.

Trend Analysis:

- Moving Averages (MA): The 5-day Moving Average has been consistently rising, indicating an upward trend in the stock price.

- MACD: The MACD line has been increasing, and the MACD Histogram has been consistently positive, suggesting bullish momentum.

Momentum Analysis:

- RSI: The Relative Strength Index (RSI) has been fluctuating around the mid-level, indicating a neutral momentum.

- Stochastic Oscillator: Both %K and %D have been fluctuating, showing indecision in momentum.

Volatility Analysis:

- Bollinger Bands (BB): The stock price has been trading within the upper Bollinger Band, indicating increased volatility.

Volume Analysis:

- On-Balance Volume (OBV): The OBV has been fluctuating, suggesting mixed sentiment among investors.

- Chaikin Money Flow (CMF): The CMF has been negative, indicating selling pressure in the stock.

Key Observations:

- The trend indicators suggest a bullish sentiment with rising moving averages and positive MACD.

- Momentum indicators show mixed signals with RSI hovering around neutrality and stochastic oscillators showing indecision.

- Volatility has increased as the stock price is trading near the upper Bollinger Band.

- Volume indicators reflect mixed sentiment with fluctuating OBV and negative CMF.

Conclusion:

Based on the analysis of technical indicators, the stock price of GL is likely to continue its upward trend in the next few days. The bullish trend indicated by moving averages and MACD, coupled with increased volatility near the upper Bollinger Band, suggests potential for further price appreciation. However, the mixed momentum and volume signals indicate a need for caution, as there might be periods of consolidation or minor pullbacks amidst the overall bullish trend.

Recommendation:

- Long-Term Investors: Consider holding onto positions or adding to them based on the bullish trend.

- Short-Term Traders: Look for opportunities to enter on pullbacks or consolidation phases for potential short-term gains.

- Risk Management: Set stop-loss orders to protect profits and manage risks in case of unexpected market movements.

In conclusion, while the overall outlook for GL stock is bullish, it is essential to monitor the momentum and volume indicators closely for any signs of a potential reversal or consolidation.