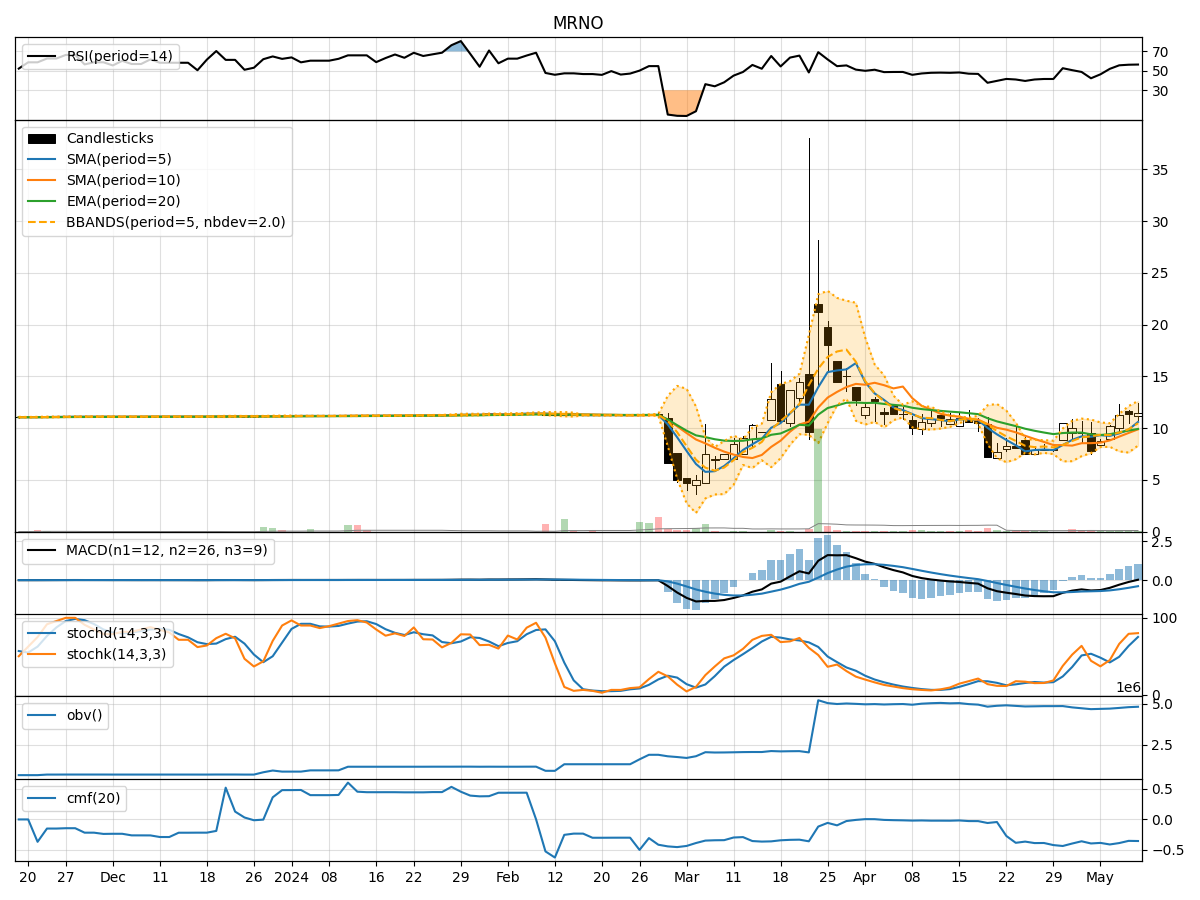

Technical Analysis of MRNO 2024-05-10

Overview:

In analyzing the technical indicators for MRNO over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive assessment of the stock's potential price movement. By examining these key factors, we aim to offer valuable insights and predictions for the next few days.

Trend Analysis:

- Moving Averages (MA): The 5-day moving average has been consistently rising, indicating a bullish trend.

- MACD: The MACD line has been increasing, with the MACD histogram also showing positive values, suggesting bullish momentum.

- RSI: The RSI has been gradually increasing but remains below the overbought threshold, indicating room for further upside.

Momentum Analysis:

- Stochastic Oscillator: Both %K and %D lines of the Stochastic Oscillator are in the overbought zone, signaling potential overextension.

- Williams %R: The Williams %R is also in the oversold territory, suggesting a possible reversal in the short term.

Volatility Analysis:

- Bollinger Bands: The stock price has been trading within the upper Bollinger Band, indicating an overbought condition.

- Bollinger %B: The %B indicator is above 0.5, suggesting a bullish trend.

Volume Analysis:

- On-Balance Volume (OBV): The OBV indicator has been steadily increasing, reflecting positive buying pressure.

- Chaikin Money Flow (CMF): The CMF is negative, indicating some distribution in the stock.

Conclusion:

Based on the analysis of the technical indicators, the stock of MRNO is currently exhibiting overbought conditions in terms of momentum and volatility. While the trend remains bullish, the overbought signals from the Stochastic Oscillator and Williams %R suggest a potential pullback or consolidation in the near future. The increasing OBV and positive MACD values support the bullish trend, but caution is advised due to the overbought nature of the stock.

Recommendation:

Considering the overbought signals and the potential for a short-term reversal, investors should exercise caution and consider taking profits or implementing risk management strategies. Monitoring the price action closely for signs of a reversal or consolidation would be prudent. Additionally, waiting for a pullback to key support levels before considering new long positions may present a better risk-reward opportunity.

In conclusion, while the overall trend for MRNO is bullish, the technical indicators suggest a possible correction or consolidation in the short term. It is essential for investors to stay vigilant and adapt their strategies accordingly to navigate potential market fluctuations.