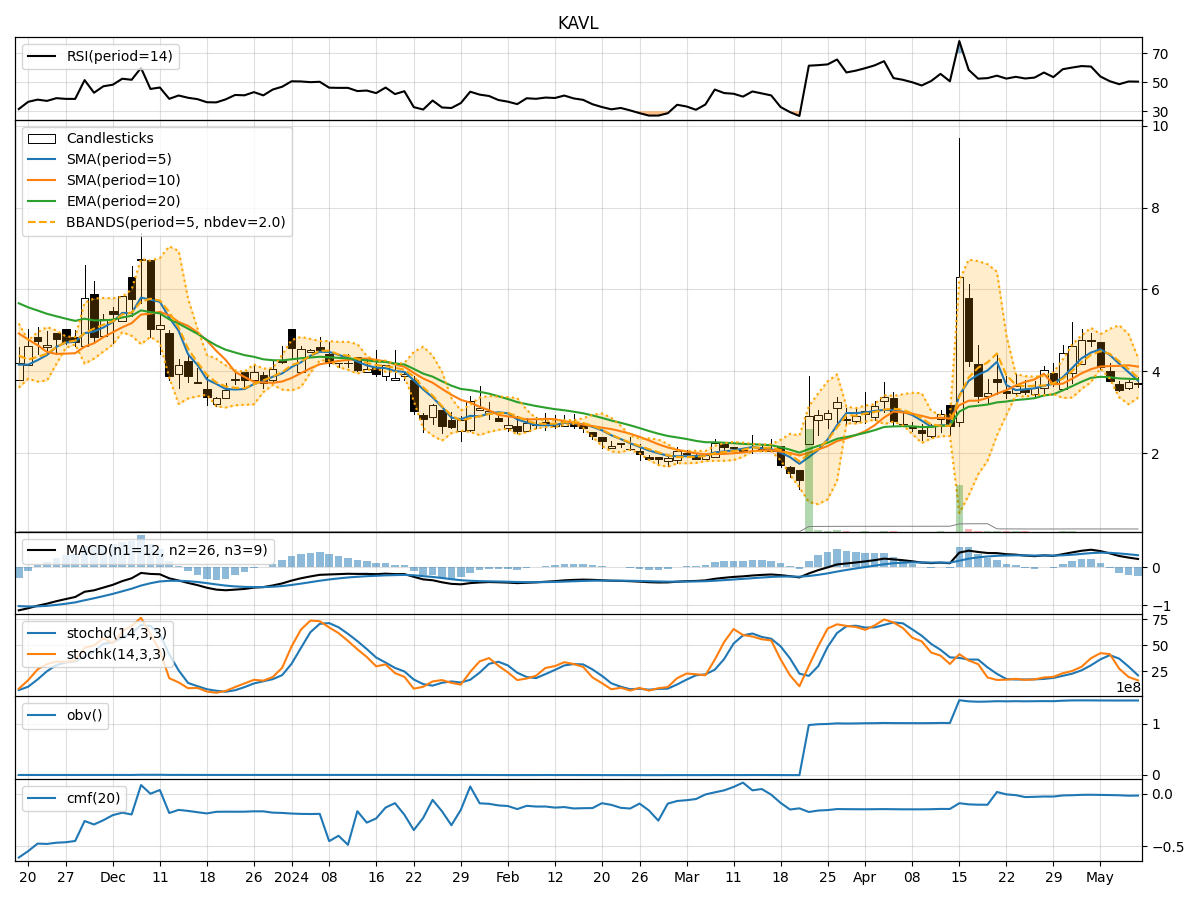

Technical Analysis of KAVL 2024-05-31

Overview:

In analyzing the technical indicators for KAVL over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible stock price movement. By examining these key factors, we aim to offer valuable insights and predictions for the upcoming days.

Trend Analysis:

- Moving Averages (MA): The 5-day MA has been consistently below the closing prices, indicating a downward trend.

- MACD: The MACD line has been decreasing, with the MACD histogram also showing a downward trend.

- EMA: The EMA values have been declining, further confirming the bearish trend.

Key Observation: The trend indicators suggest a strong bearish sentiment in the stock price movement.

Momentum Analysis:

- RSI: The RSI values have been decreasing, indicating a weakening momentum.

- Stochastic Oscillator: Both %K and %D values have been declining, signaling a bearish momentum.

- Williams %R: The values have been consistently in the oversold territory, reflecting a strong bearish momentum.

Key Observation: Momentum indicators align with the trend analysis, showing a significant bearish momentum in the stock.

Volatility Analysis:

- Bollinger Bands (BB): The bands have been narrowing, indicating decreasing volatility.

- Bollinger %B: The %B values have been decreasing, suggesting a reduction in volatility.

Key Observation: Volatility indicators point towards decreasing volatility in the stock price movement.

Volume Analysis:

- On-Balance Volume (OBV): The OBV values have been declining, indicating a decrease in buying pressure.

- Chaikin Money Flow (CMF): The CMF values have been negative, signaling a lack of buying interest.

Key Observation: Volume indicators support the bearish sentiment, showing a decrease in buying pressure and overall negative money flow.

Conclusion:

Based on the comprehensive analysis of trend, momentum, volatility, and volume indicators, the outlook for KAVL in the next few days is strongly bearish. The consistent downward trend, coupled with bearish momentum and decreasing volatility, suggests a high probability of further downside movement in the stock price. Additionally, the declining volume indicators indicate a lack of buying interest, reinforcing the bearish view.

Recommendation:

Considering the bearish signals across all key technical indicators, it is advisable to exercise caution or consider short positions in KAVL for the upcoming days. Traders and investors should closely monitor the price action and be prepared for potential downside movements in the stock. It is essential to set stop-loss levels and adhere to risk management strategies to mitigate potential losses in a volatile market environment.