Technical Analysis of GSUN 2024-05-10

Overview:

In analyzing the technical indicators for GSUN over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive assessment of the stock's potential price movement. By examining these key factors, we aim to offer insights and predictions for the next few days.

Trend Analysis:

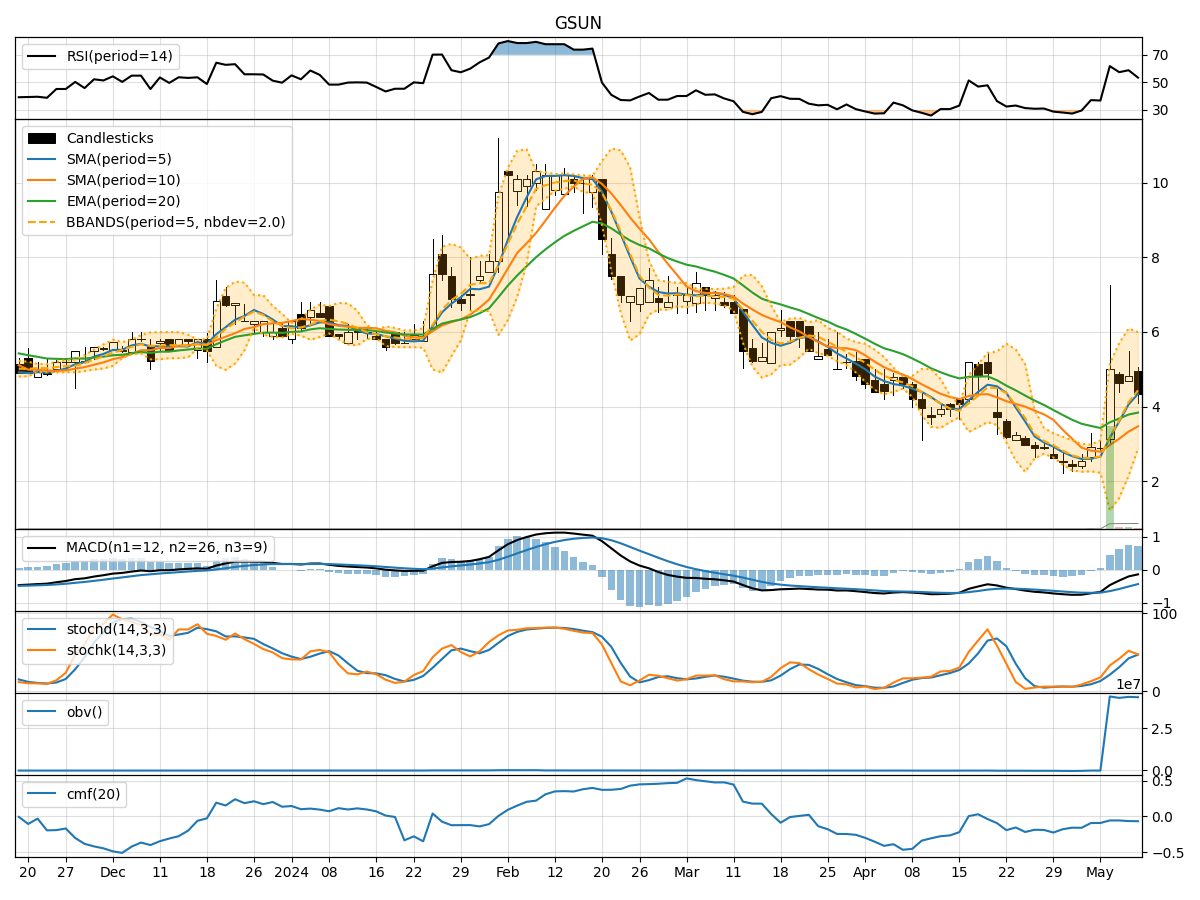

- Moving Averages (MA): The 5-day MA has been consistently above the closing prices, indicating a potential bullish trend.

- MACD: The MACD line has been negative but showing signs of convergence with the signal line, suggesting a possible trend reversal.

Key Observation: The stock is currently in a consolidation phase with a potential bullish bias.

Momentum Analysis:

- RSI: The RSI has been fluctuating around the mid-level, indicating indecision in the market.

- Stochastic Oscillator: Both %K and %D have been moving within a range, reflecting a lack of strong momentum.

Key Observation: Momentum is neutral, suggesting a lack of clear direction in the short term.

Volatility Analysis:

- Bollinger Bands (BB): The bands have been narrowing, indicating decreasing volatility.

Key Observation: Volatility is decreasing, which could lead to a period of consolidation or a breakout.

Volume Analysis:

- On-Balance Volume (OBV): The OBV has been relatively stable, showing no significant divergence.

- Chaikin Money Flow (CMF): The CMF has been negative, indicating selling pressure in the market.

Key Observation: Volume indicators suggest a lack of strong buying interest, potentially limiting upward momentum.

Conclusion:

Based on the analysis of the technical indicators, the next few days for GSUN could see sideways movement with a slight bullish bias. The stock is likely to continue consolidating within a range, with limited volatility and momentum. Traders should exercise caution and wait for clearer signals before taking significant positions.

Recommendation:

- Short-term Traders: Consider scalping within the current range but be mindful of the lack of strong momentum.

- Long-term Investors: Monitor for a clear breakout above key resistance levels before considering new positions.

By carefully monitoring the evolving technical signals and market dynamics, investors can make informed decisions aligned with the prevailing trends in GSUN.