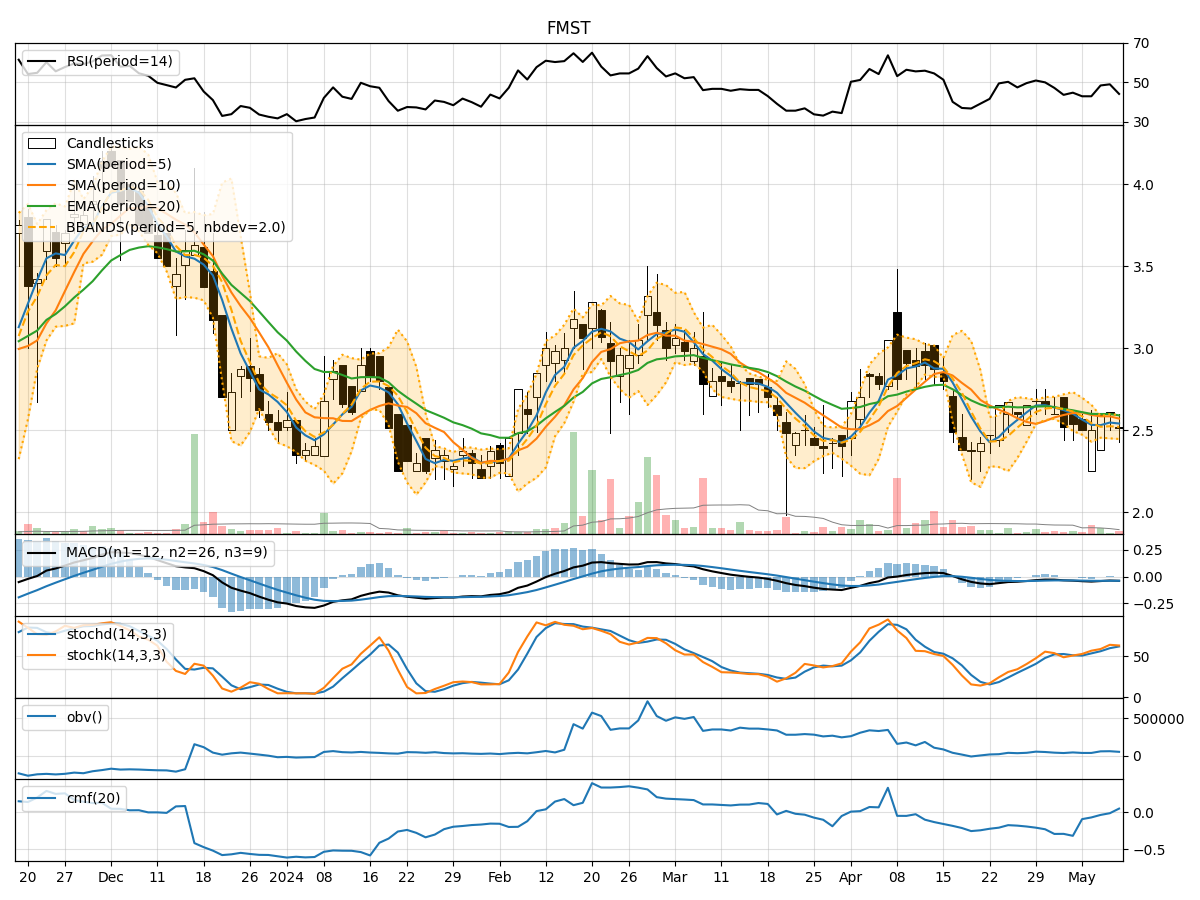

Technical Analysis of FMST 2024-05-10

Overview:

In the last 5 trading days, FMST stock has shown mixed signals across various technical indicators. The stock price has been fluctuating within a narrow range, indicating indecision in the market. To determine the possible future price movement, we will analyze the trend, momentum, volatility, and volume indicators in detail.

Trend Indicators:

- Moving averages (MA) show a slight downtrend, with the 5-day MA below the 10-day simple moving average (SMA).

- Exponential moving average (EMA) is also trending downwards, indicating a bearish sentiment.

- MACD line is below the signal line, suggesting a bearish momentum.

- Overall, the trend indicators point towards a downward movement in the stock price.

Momentum Indicators:

- Relative Strength Index (RSI) is below 50, indicating a bearish momentum.

- Stochastic oscillators show a mixed signal, with %K above %D but both in overbought territory.

- Williams %R is also in the oversold region, suggesting a potential reversal.

- Momentum indicators suggest a bearish sentiment in the short term.

Volatility Indicators:

- Bollinger Bands are narrowing, indicating reduced volatility.

- The lower and upper Bollinger Bands are converging, suggesting a potential breakout.

- Bollinger Band %B is near 0.5, indicating a balanced market sentiment.

- Volatility indicators signal a sideways movement or a potential breakout in the near future.

Volume Indicators:

- On-Balance Volume (OBV) has been fluctuating, showing no clear trend.

- Chaikin Money Flow (CMF) is negative, indicating selling pressure.

- Volume indicators do not provide a clear direction for the stock price.

Conclusion:

Based on the analysis of trend, momentum, volatility, and volume indicators, the overall outlook for FMST stock is bearish in the short term. The trend indicators suggest a downward movement, supported by bearish momentum signals. Volatility indicators point towards a potential breakout, while volume indicators do not provide a strong indication.

Key Conclusion: The next few days are likely to see a downward movement in FMST stock price, with a possibility of a breakout due to narrowing Bollinger Bands. Traders should exercise caution and consider implementing risk management strategies in their trading decisions.