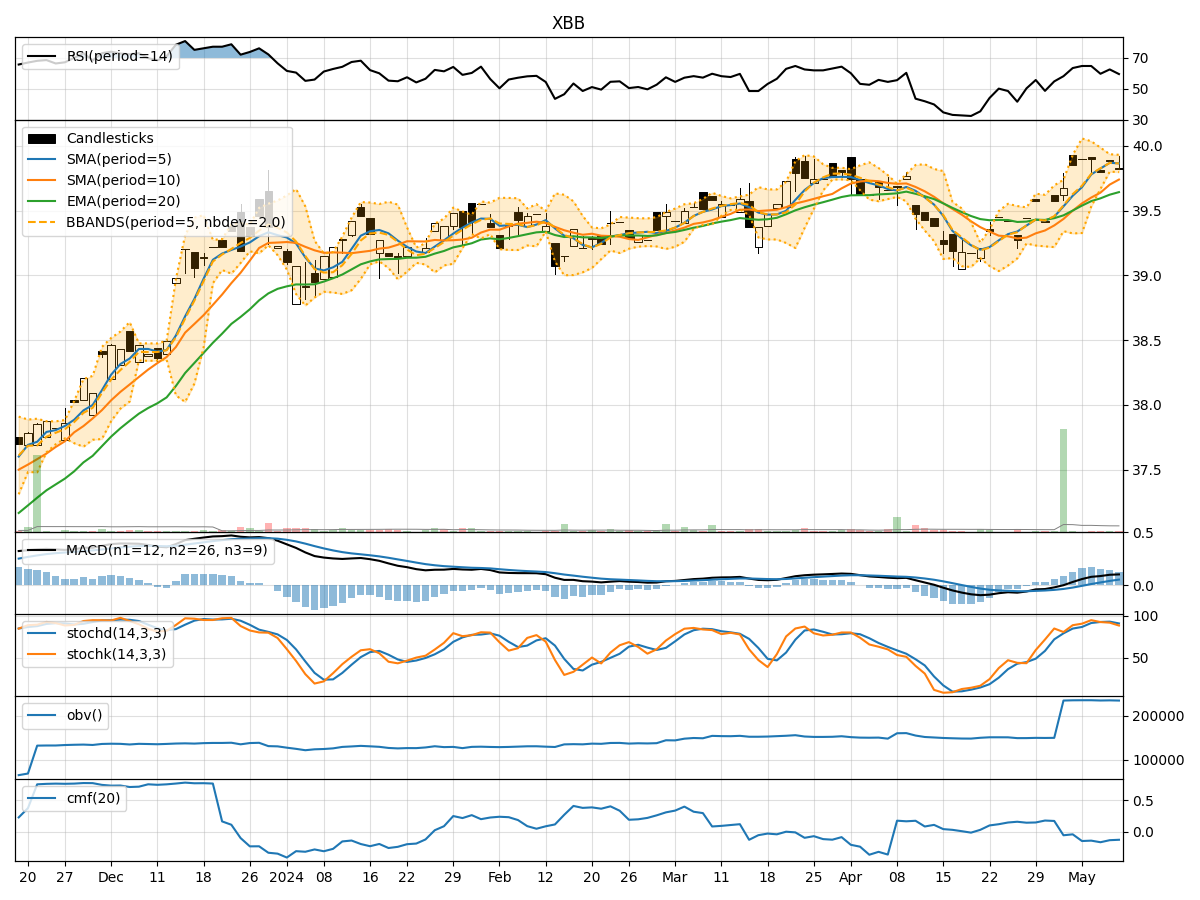

Technical Analysis of XBB 2024-05-10

Overview:

In analyzing the technical indicators for XBB over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible stock price movement in the coming days. By examining these key indicators, we aim to offer valuable insights and predictions for informed decision-making.

Trend Analysis:

- Moving Averages (MA): The 5-day Moving Average (MA) has been consistently above the Simple Moving Average (SMA) and Exponential Moving Average (EMA), indicating a bullish trend.

- MACD: The MACD line has been above the signal line, with both showing an upward trend, suggesting positive momentum in the stock price.

- Conclusion: The trend indicators point towards an upward trajectory for XBB.

Momentum Analysis:

- RSI: The Relative Strength Index (RSI) has been fluctuating around the 60-70 range, indicating moderate momentum.

- Stochastic Oscillator: Both %K and %D have been in the overbought zone, suggesting a potential reversal or consolidation.

- Conclusion: Momentum indicators signal a neutral to slightly bearish sentiment for XBB.

Volatility Analysis:

- Bollinger Bands (BB): The stock price has mostly stayed within the Bollinger Bands, with the bands narrowing, indicating decreasing volatility.

- Conclusion: Volatility indicators suggest a low volatility environment for XBB.

Volume Analysis:

- On-Balance Volume (OBV): The OBV has been relatively stable, indicating a balance between buying and selling pressure.

- Chaikin Money Flow (CMF): The CMF has been negative, suggesting outflow of money from the stock.

- Conclusion: Volume indicators reflect a neutral to slightly bearish sentiment for XBB.

Overall Conclusion:

Based on the analysis of trend, momentum, volatility, and volume indicators, the overall outlook for XBB in the next few days is as follows: - Trend: Upward - Momentum: Neutral to slightly bearish - Volatility: Low - Volume: Neutral to slightly bearish

Final Recommendation:

Considering the mixed signals from momentum and volume indicators, alongside the strong bullish trend and low volatility, it is likely that XBB may experience some consolidation or a minor pullback in the near term. Traders should exercise caution and consider potential entry points during any dips for long positions.