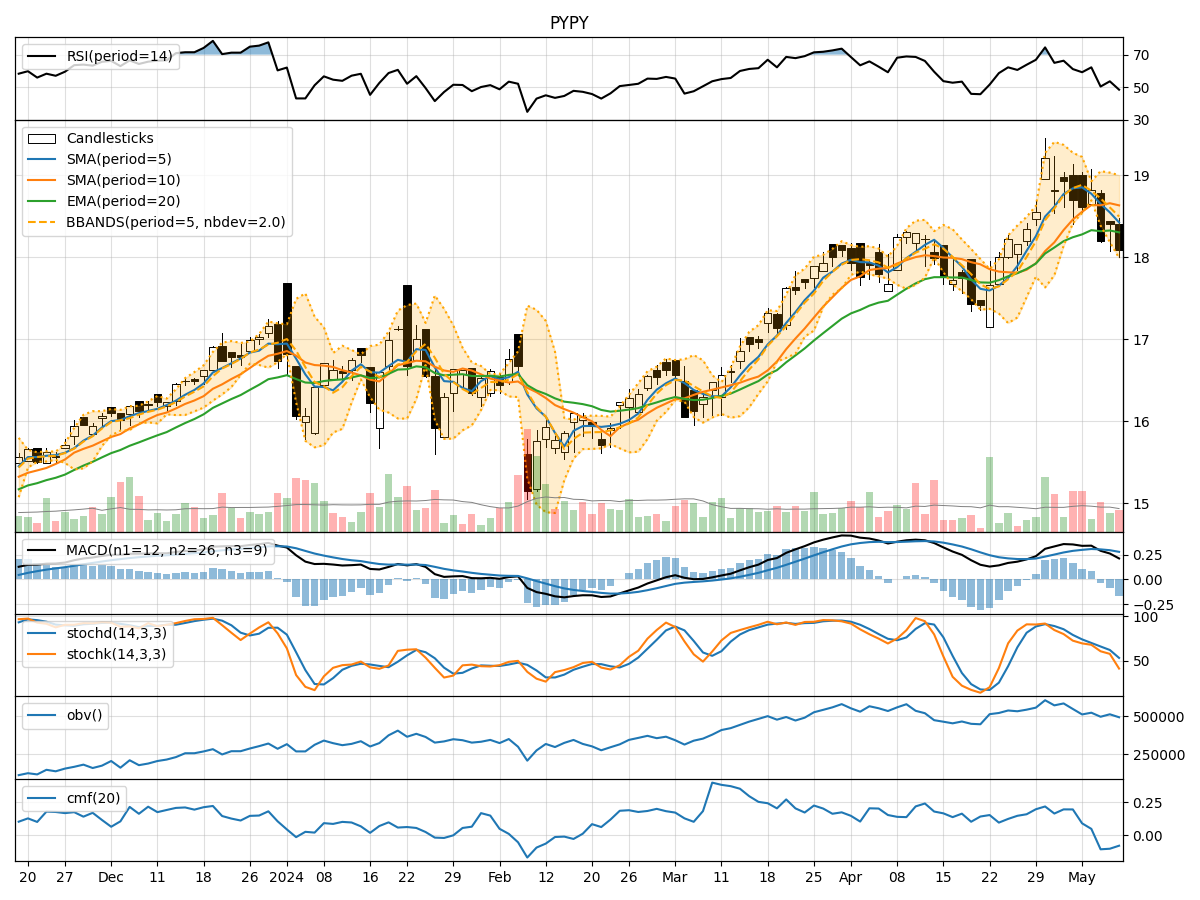

Technical Analysis of PYPY 2024-05-10

Overview:

In analyzing the technical indicators for PYPY stock over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible future stock price movement. By examining these key indicators, we aim to offer valuable insights and predictions for the upcoming trading days.

Trend Indicators:

- Moving Averages (MA): The 5-day MA has been fluctuating around the closing prices, indicating short-term price trends. The SMA(10) and EMA(20) have shown slight variations but have not provided a clear trend direction.

- MACD: The MACD line has been positive, indicating a potential bullish momentum. However, the MACD Histogram has been decreasing, suggesting a possible weakening of the bullish momentum.

Momentum Indicators:

- RSI: The RSI has been oscillating around the 50 level, indicating a neutral momentum in the stock.

- Stochastic Oscillator: Both %K and %D have been declining, suggesting a bearish momentum in the short term.

- Williams %R: The Williams %R is in the oversold territory, indicating a potential reversal or bounce in the stock price.

Volatility Indicators:

- Bollinger Bands: The stock price has been trading within the Bollinger Bands, indicating a period of consolidation. The bands have not shown significant expansion or contraction.

- Bollinger %B: The %B indicator has been hovering around the midline, suggesting a balanced volatility in the stock.

Volume Indicators:

- On-Balance Volume (OBV): The OBV has shown mixed signals, with no clear trend in volume accumulation or distribution.

- Chaikin Money Flow (CMF): The CMF has been negative, indicating a potential outflow of money from the stock.

Conclusion:

Based on the analysis of the technical indicators, the stock is currently in a sideways consolidation phase with bearish momentum in the short term. The lack of clear trend direction in moving averages, coupled with mixed signals from momentum and volume indicators, suggests a period of uncertainty in the stock price movement.

Recommendation:

Considering the current market dynamics and technical signals, it is advisable to exercise caution in trading PYPY stock in the upcoming days. Traders may consider waiting for more definitive signals or confirmation of a trend before making significant trading decisions. Monitoring key support and resistance levels, as well as potential reversal patterns, can provide valuable insights for navigating the market effectively.