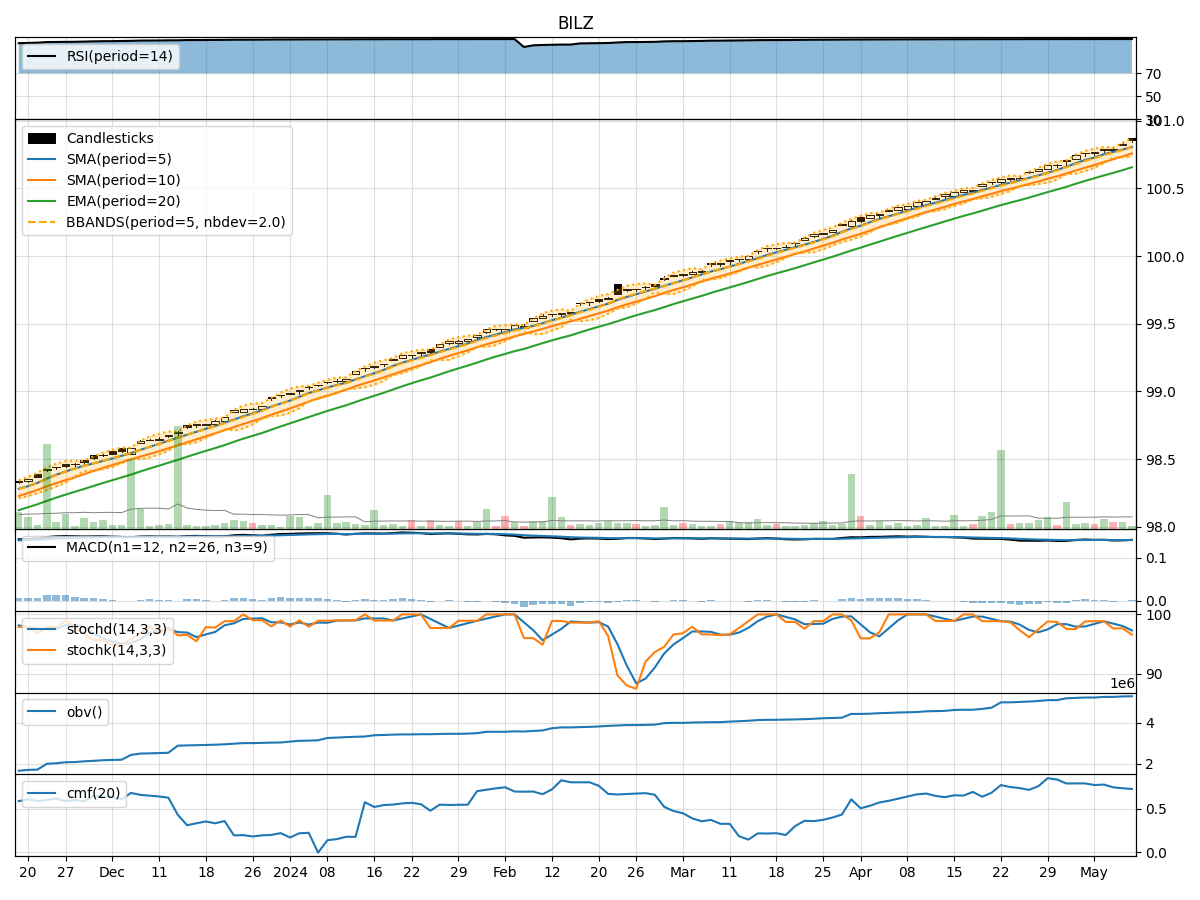

Technical Analysis of BILZ 2024-05-10

Overview:

In analyzing the technical indicators for BILZ over the last 5 days, we will delve into the trend, momentum, volatility, and volume indicators to provide a comprehensive outlook on the possible stock price movement. By examining these key aspects, we aim to offer valuable insights and predictions for the upcoming days.

Trend Analysis:

- Moving Averages (MA): The 5-day Moving Average (MA) has been consistently above the Simple Moving Average (SMA) and Exponential Moving Average (EMA), indicating a bullish trend.

- MACD: The MACD line has been positive, with the MACD Histogram showing an increasing trend, suggesting bullish momentum in the stock.

Momentum Analysis:

- RSI: The Relative Strength Index (RSI) has been at 100.0 for all 5 days, indicating overbought conditions.

- Stochastic Oscillator: Both %K and %D have been decreasing, signaling a bearish divergence.

Volatility Analysis:

- Bollinger Bands (BB): The stock price has been consistently within the Bollinger Bands, with the %B indicating price consolidation.

- Average True Range (ATR): The ATR has been relatively stable, suggesting low volatility in the stock.

Volume Analysis:

- On-Balance Volume (OBV): The OBV has shown a slight increase over the 5 days, indicating positive buying pressure.

- Chaikin Money Flow (CMF): The CMF has been positive but decreasing, suggesting weakening buying pressure.

Conclusion:

Based on the analysis of the technical indicators, the stock of BILZ is currently exhibiting a bullish trend supported by the moving averages and MACD. However, the momentum indicators such as RSI and Stochastic Oscillator point towards overbought conditions and a potential bearish reversal in the short term. The volatility remains relatively low, indicating price consolidation within the Bollinger Bands.

Considering the mixed signals from the momentum indicators and the weakening buying pressure shown by the CMF, it is likely that the stock price of BILZ may experience sideways movement or a minor correction in the next few days. Traders should exercise caution and consider implementing risk management strategies to navigate the potential market uncertainties.

In conclusion, while the overall trend remains bullish, the conflicting signals from momentum and volume indicators suggest a cautious approach in the short term. It is essential to monitor the price action closely for any signs of a reversal or continuation of the current trend.